Stop Living Payday to Payday: How to Create Financial Breathing Room (Even If Money’s Tight)

If you feel like your money disappears the second it hits your account, you’re not alone.

For so many women especially single mums payday isn’t a moment of relief.

It’s a wave of anxiety.

That tight chest feeling when you know the rent’s about to clear.

Groceries need topping up.

Fuel prices make you wince.

And before you’ve even had a chance to exhale, the numbers in your bank account are shrinking… fast.

You feel the panic rise.

Maybe there’s a part of you that doesn’t even want to look.

Because facing the numbers feels heavy.

It feels defeating.

“If only I had more money…”

“If I just earned a bit more, things would be fine…”

Sound familiar?

But here’s the truth most people don’t talk about:

More money doesn’t automatically fix things.

If you don’t have a system to support it, more money often slips through your fingers just as fast.

People are a creature of habit and patterns most likely it’ll just disappear through old habits, unexpected bills, and reactive spending.

It’s not because you’re careless.

It’s because money loves clarity and without it, it flows out wherever it can.

What you really need is financial breathing room.

Not more hustle.

Not more pressure.

So what does creating financial breathing room actually mean?

It means intentionally slowing down the flow of money going out, so that — even temporarily — you’re spending less than what’s coming in.

It’s not about deprivation and It’s not forever. It’s about giving yourself space to breathe.

Creating breathing room looks like:

Pressing pause on non-essential outflows.

Plugging leaks (subscriptions, mindless spending, things not aligned with your priorities).

Reassessing priorities and being intentional about where your dollars go.

Making conscious, informed choices to get your spending under your income.

Even if it’s just a small margin at first that space is what stops the drowning feeling.

Breathing room is how you regain control.

It’s how you stop the stress cycle each week

And once you have that, you’re no longer reacting to money.

You’re leading it.

3 Simple Shifts to Create Financial Breathing Room (Even If You’re on a Tight Budget)

These aren’t fancy budgeting hacks.

These are small tweaks that reduce stress, give you clarity, and create space to breathe.

1. Separate Your Bills from Your Spending Money

Why? Because when it’s all lumped together, you spend from the same pot… and suddenly, there’s not enough left for bills.

What to do:

Open a separate Bills Account.

Add up your essential monthly bills.

Divide that by how often you get paid.

Every payday, transfer that amount straight into your Bills Account.

Result:

Your bills are always covered.

No more “oops, I spent the electricity money” moments.

2. Plan for the “Unexpected” (That You Know is Coming)

This one gets me every time, there are quite a lot of expense that you know will come up through out the year and yet we don’t plan for them and act surprised when we suddenly need to pay for school photos or sporting registration fees, School fees. Rego. Christmas and birthdays. They’re not emergencies, but they hit like one when you’re not prepared.

What to do:

Make a list of all the irregular expenses you know are coming.

Set up a Future Fund Account.

Start setting aside small, regular amounts each payday.

Even $10-$20 at a time makes a difference.

Result:

You stop being blindsided by “unexpected” expenses and start feeling prepared.

3. Simplify Your Day-to-Day Spending

It’s not about restricting yourself. It’s about knowing your limits and spending guilt-free until your out. It’s important to not take from your other buckets to top this one up when this bucket gets low.

If that does happen it’s actually a sign to look a little deeper here and notice whats going on with your spening, where are you spending unconsciously? Is your spending aligned with what you truly value?

Asking questions like this is your greatest tool for success in turning things around financially because what got you here now won’t get you to where you want to be financially so we need to get to the bottom of whats actually going on.

Once you have the awareness you have the power to choose differently.

What to do:

Set a realistic weekly spending limit for groceries, fuel, coffees, fun etc.

Use cash, or a separate account to stick to it.

This isn’t punishment.

It’s permission to enjoy your money within boundaries that you decide.

Result:

You enjoy spending without the fear of “what if this leaves me short?” because everything else is already taken care of.

My Turning Point: The Bliss Buckets

When I was stuck in the scramble, what changed everything for me wasn’t earning more it was finally seeing where my money needed to flow.

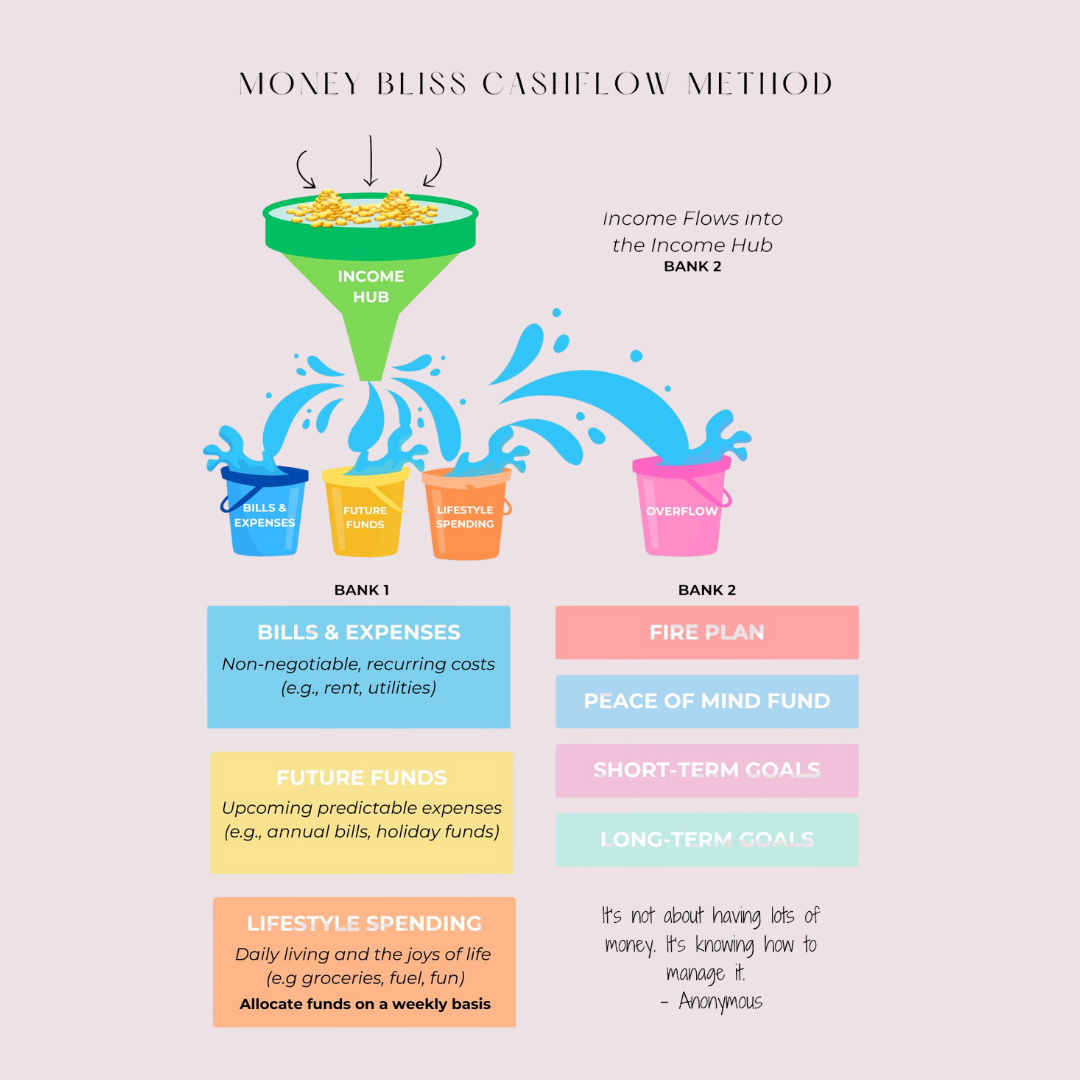

That’s why I created the Money Bliss Cashflow Method a simple way to give every dollar a “home” so you always know what’s covered, what’s coming up, and what you can enjoy spending.

It’s not about tracking every cent.

It’s about creating clarity and reducing the mental load that comes with money stress.

You can grab my [Money Bliss Cashflow Cheatsheet here] to learn exactly how to set this up for yourself.

This system isn’t complicated:

Your income flows into your Income Hub.

From there, it’s allocated into clear “buckets”:

Bills & Expenses (the non-negotiables)

Future Funds (for predictable expenses like rego, school fees)

Lifestyle Spending (for groceries, fuel, fun)

And Overflow, which you intentionally direct towards your priorities: debt, peace of mind savings, goals, or fun things you’re working towards.

This is how you create financial breathing room that lasts.

If You’re Tired of Playing Catch-Up, This Is for You

I get it. Right now, it probably feels like you’re always playing catch up. Every time money comes in, it’s already spoken for, Bills. Groceries. Kids. Life.

And then you’re holding your breath until the next payday, hoping nothing unexpected pops up because honestly, there’s no room for it.

You’re not bad with money.

You’re not careless.

You’re just trying to keep up

That’s why creating financial breathing room is so important.

It’s not some fancy finance term.

It’s simply giving yourself a little space.

Space where your money isn’t already gone before it arrives.

Space where you’ve made some small, intentional choices to slow down the outflow just enough to stop treading water.

It’s in that breathing room that things start to shift.

You get to think clearly.

You get to plan, instead of just reacting

And that’s when you finally start to feel like you’re back in control.

Next Steps…

You don’t have to do this alone. If you’re ready to take your financial journey to the next level, I’ve created tools that can help you get started today, These tools are designed to keep you on track, help you refocus when needed, and empower you to take control of your financial future.

The Money Date Toolkit: your go-to bundle for creating a weekly money ritual that helps you feel clear, confident, and in control without the stress or shame.

Financial Daily Check-In Notepad: The tool that will help you connect with your money every day, making tracking and managing finances a breeze.

10 Day Financial Reset Mini-Course: A no-fluff course designed to help you reset, refocus, and rebuild a solid financial foundation in just 10 days.

Every action you take today brings you closer to the financial peace and freedom you desire.