The Financial Reset You Need When You’re Drowning in Overwhelm

You know that sinking feeling.

The bills keep piling up.

You’re juggling groceries, rent, fuel, school expenses and somehow, there’s never enough.

Every time you think you’re getting ahead, another expense hits you sideways.

I’ve been there. Completely overwhelmed, unsure where to even start.

If this sounds like you, you’re not alone and you don’t need a complicated spreadsheet or a finance degree to get back on track.

What you need is a Financial Reset.

One that feels doable. Grounded. Like a breath of fresh air.

In this post, I’ll show you:

The real reason you’re stuck in financial overwhelm (it’s not your fault)

Why traditional budgeting advice doesn’t work when you’re already drowning

My simple Financial Reset process to regain control, without panic

How this small shift can completely change how you feel about money

Why You Feel So Overwhelmed With Money (It’s Not Your Fault)

Here’s the thing no one tells you:

Most of us were never taught how to manage money in a way that actually works for real life — especially when things are hard.

You’re doing your best.

You’re juggling rent, groceries, fuel, kids’ needs, stretching every dollar until it snaps.

But when your income simply isn’t enough to cover the essentials, no amount of “cutting back” or strict budgeting is going to magically fix it.

You can’t budget your way out of being broke.

That’s the brutal reality I had to face myself.

I was living by default — avoiding my money because it felt too overwhelming to look at, yet trying to budget and set goals because that’s what you’re “supposed to do.”

But deep down, I knew the money I had wasn’t even stretching far enough right now, let alone getting me ahead.

That’s exactly why I created the Financial Reset.

It was my way of rescuing myself not with a big dramatic overhaul, but by simply getting clear on what was actuallygoing on with my money.

When I stopped avoiding it and gave myself space to assess things honestly (without shame), I was able to make informed financial decisions that helped me get my head above water.

The Financial Reset became my lifeline

A short, focused period of time to:

Stop reacting in panic

Reset my finances with clarity

Create a simple money map to navigate out of trouble

But here’s the beautiful part:

This reset isn’t just for when you’re drowning.

I’ve since taught this practice to women who weren’t in dire straits they simply wanted a refresh.

Sometimes you just need to hit pause, get back on track, and realign your money with where you actually want to go.

Maybe that’s you right now.

Maybe you want a do-over not because your struggling but because you’re ready to do better with your money.

The Financial Reset is how you take back control either way designed for real life.

The Financial Reset Process: 3 Simple Steps to Regain Control

When I was drowning, I created my own Financial Reset process.

It’s not magic — it’s practical, gentle, and designed for busy women who don’t have hours to “sort their finances.”

Step 1: Pause & Get Clear

Before you can fix anything, you need to see where you’re really at.

This isn’t about judgment — it’s about awareness.

List your must-pay bills & essentials (rent, food, utilities).

Get real with your income (what’s actually coming in).

This alone brings immediate clarity. You go from “I don’t know where my money is going” to “Okay, here’s what I’m working with.”

Step 2: Prioritise Without Panic

When everything feels urgent, it’s easy to freeze.

A Financial Reset helps you sort what truly needs your attention.

What bills need to be covered this week?

Can any expenses be paused, reduced, or renegotiated?

What can you let go of (guilt-free) for now?

It’s about making temporary, strategic choices to catch your breath.

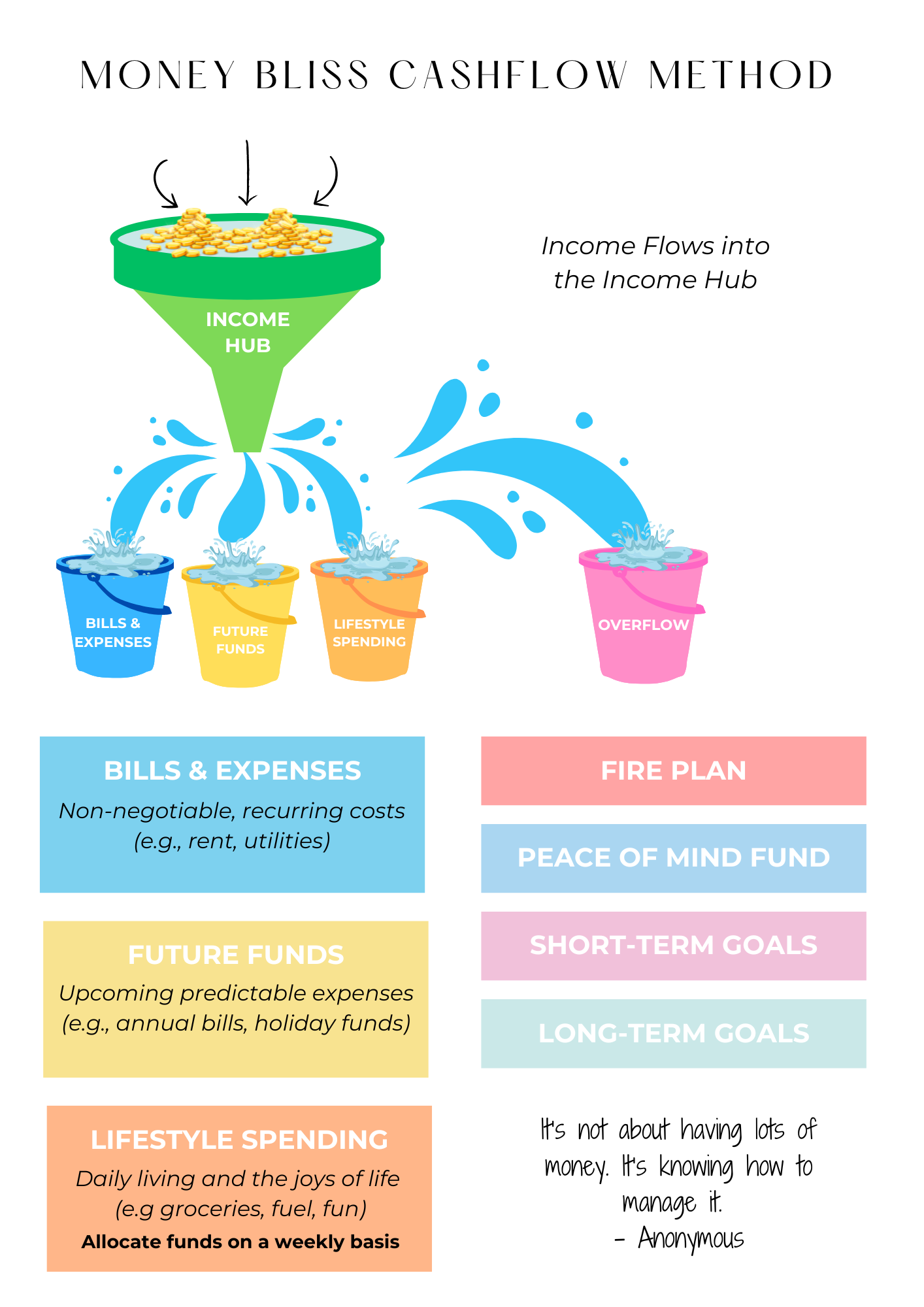

Step 3: Create a Simple Cash Flow Map

Forget complicated budgets.

A basic Cash Flow Map gives your income a job, so you’re not left wondering where it all went.

Essentials first

Upcoming known expenses next (future funds)

Then lifestyle spending

Anything left goes toward peace of mind (savings, debt payments, etc.)

Even if the numbers are tight, this structure reduces the mental load.

The Shift: From Overwhelmed to “On Top of It”

Will a Financial Reset solve everything overnight? No.

But it will give you clarity, direction, and a plan — which feels a million times better than spinning in overwhelm.

When you know exactly what needs your focus, you can stop reacting to every financial fire and start moving forward intentionally.

This reset is how I climbed out of constant money stress — one small, clear step at a time.

You Don’t Have to Figure It Out Alone

If reading this has you thinking “I need this, but I don’t even know where to start”

I created the 10-Day Financial Reset with you in mind.

It’s not a big scary budget overhaul.

It’s not about being perfect with money.

It’s a gentle, step-by-step guide to help you:

Get clear on what’s really going on with your money

Create a simple money flow that actually fits your life

Stop the constant stress and start making decisions that move you forward

This is the exact process I used to get my own finances out of the mess and I’ve taught it to so many women who just wanted to stop feeling behind.

Whether you’re in crisis mode or just want to hit refresh, this reset will give you that much-needed “I’ve got this” feeling.

No judgment. No overwhelm.

Just small, doable actions that make a big difference.

[Click here to join the waitlist for the 10-Day Financial Reset ]

You deserve to feel on top of your money again.

Let’s get you there.

Next Steps…

You don’t have to do this alone. If you’re ready to take your financial journey to the next level, I’ve created tools that can help you get started today, These tools are designed to keep you on track, help you refocus when needed, and empower you to take control of your financial future.

The Money Bliss Cashflow Method Cheatsheet: Your quick-start guide to organising your finances in a balanced and stress-free way.

Financial Daily Check-In Notepad: The tool that will help you connect with your money every day, making tracking and managing finances a breeze.

10 Day Financial Reset Mini-Course: A no-fluff course designed to help you reset, refocus, and rebuild a solid financial foundation in just 10 days.

Every action you take today brings you closer to the financial peace and freedom you desire.